The Debt Service Coverage Ratio (DSCR) loan requires a clear deed, crucial for assessing property profitability and securing favorable terms. Borrowers must maintain meticulous records, provide thorough documentation, and understand financial metrics to qualify. Lenders conduct appraisals, distinguishing between deeds (ownership transfer) and titles (legal possession), ensuring collateral value accuracy. Strategic planning, including accurate income analysis and flexible repayment options, is essential for successful DSCR loan navigation.

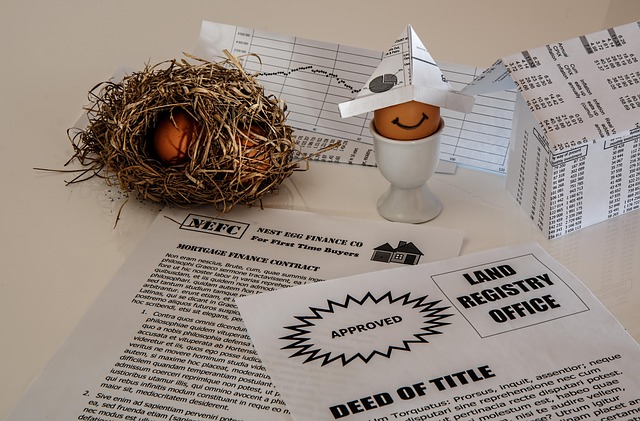

In the dynamic landscape of financing, understanding Deed of Secure Credit (DSCR) loan requirements is paramount for both lenders and borrowers alike. As a cornerstone of commercial real estate transactions, DSCR loans offer critical capital access while ensuring investment security. However, navigating these requirements can be labyrinthine, with nuances impacting feasibility and terms. This authoritative piece delves into the intricacies of DSCR loan criteria, providing an indispensable resource for professionals seeking to optimize their financing strategies. By exploring key factors such as debt service coverage ratios, collateral evaluation, and borrower eligibility, we equip you with the knowledge to confidently navigate this complex yet essential aspect of real estate finance.

- Understanding DSCR Loan Basics: A Comprehensive Overview

- Eligibility Criteria: Who Qualifies for DSCR Loans?

- Documenting Financial Health: Key Requirements

- Property Assessment and Valuation: Ensuring Security

- Deed Preparation and Legal Considerations

- Repayment Strategies: Navigating DSCR Loan Terms

Understanding DSCR Loan Basics: A Comprehensive Overview

The Debt Service Coverage Ratio (DSCR) loan is a financial instrument that requires borrowers to demonstrate their ability to service debt through their expected future cash flows. This method assesses a property’s profitability and its potential to cover ongoing mortgage payments. Understanding DSCR loans involves grasping the fundamental relationship between a deed and the financial health of a real estate asset.

A deed, in simple terms, is legal documentation that grants ownership rights over property. While often confused with title, which represents the overall right of ownership, a deed specifically outlines the borrower’s interest in a property. In the context of DSCR loans, lenders carefully examine the deed to ensure the borrower has clear and marketable title, signaling financial stability. This is because a borrower’s ability to service debt directly correlates with their control over the property and the potential for future cash flow generation.

For instance, a commercial real estate investor seeking a DSCR loan would need to provide evidence that they possess the deed to the property, free and clear of any liens or encumbrances. Lenders will then analyze the property’s operating income, expenses, and debt obligations to calculate the DSCR ratio. A higher DSCR indicates greater coverage of debt service, making the investment a more attractive prospect for financing. West USA Realty, a leading real estate brand, emphasizes this point when advising clients, “A clear deed is half the battle won in securing favorable loan terms.”

By understanding the interplay between deeds and financial assessments, borrowers can better navigate DSCR loan requirements. This involves maintaining meticulous records, ensuring proper property documentation, and seeking professional advice to optimize their application.

Eligibility Criteria: Who Qualifies for DSCR Loans?

Eligible borrowers play a pivotal role in securing DSCR loans, which require a strong financial foundation and specific criteria to meet. Unlike traditional loans that heavily rely on credit scores and history, DSCR loans assess a borrower’s ability to service debt through their income and cash flow. This method ensures lenders mitigate risk effectively, especially in commercial real estate transactions.

To qualify, borrowers must demonstrate substantial income streams capable of covering loan obligations. Lenders typically require detailed financial statements, including tax returns and bank records, to verify these income sources. Additionally, a robust debt service coverage ratio (DSCR) is essential; this ratio compares the borrower’s net operating income to their loan payments, ensuring they can comfortably manage repayments.

West USA Realty experts note that eligibility also depends on the strength of the underlying deed. A clear and marketable title is non-negotiable, as it safeguards the lender’s interest in the property. In some cases, lenders might accept a leasehold interest with substantial remaining term and strong tenant credits, but this is exception rather than rule. Borrowers should anticipate providing thorough documentation to establish their claim to the property, further solidifying their eligibility for these loans.

Documenting Financial Health: Key Requirements

When it comes to DSCR (Debt Service Coverage Ratio) loan requirements, documenting financial health is a critical aspect for both borrowers and lenders. The primary focus here is on the deed, which represents legal ownership, versus the title, which signifies the right to possess and enjoy property. Lenders scrutinize a borrower’s financial standing to ensure they can reliably service their debt, with the DSCR serving as a key metric. A robust financial profile increases the likelihood of approval and more favorable loan terms.

Key requirements involve presenting clear and comprehensive financial documentation. This typically includes tax returns for the past few years, bank statements, investment portfolios, and business financial statements if applicable. For self-employed individuals, additional documents like bank records, personal financial statements, and business income/expense reports may be demanded. The goal is to offer a detailed view of the borrower’s financial health, which is assessed against established industry benchmarks and risk profiles.

West USA Realty emphasizes the importance of accuracy and timeliness in financial disclosures. Lenders often require these documents to be no older than a specified period, typically 3-6 months. Borrowers should anticipate thorough verification processes, including cross-referencing information from multiple sources. Ensuring all financial records are up-to-date and error-free enhances the credibility of the borrower’s application, significantly impacting the chances of securing a DSCR loan at competitive rates.

Property Assessment and Valuation: Ensuring Security

Property Assessment and Valuation play a critical role in ensuring the security of DSCR loans. Before approving any loan, lenders need to conduct thorough appraisals to determine the value of the real estate collateral. This process involves examining various factors such as location, market trends, property condition, and comparable sales data. A precise valuation is essential to mitigate risks for both lenders and borrowers. Inaccurate assessments can lead to defaults, while conservative estimates safeguard the lender’s interest in case of unforeseen circumstances or a decline in the property market.

One key distinction to understand here is the difference between a deed and a title. While a deed conveys ownership rights, the title represents the legal right to possess and use the property free from any liens or encumbrances. Lenders thoroughly review both documents during their assessment to ensure there are no outstanding issues that could affect the property’s value or the borrower’s ability to repay the loan. For instance, a previous owner’s undisclosed litigation against the property could taint its title, impacting its market worth and the overall security of the DSCR loan.

West USA Realty emphasizes the importance of engaging professional appraisers who are familiar with local markets and can provide nuanced insights. They suggest borrowers work closely with their lenders to select qualified assessors, ensuring transparency throughout the process. Regular reappraisals are also recommended, especially for properties in dynamic markets, to account for changing conditions that may impact the deed vs title status and overall collateral value. This proactive approach fosters trust between lenders and borrowers, facilitating smoother transactions and reducing potential risks associated with DSCR loans.

Deed Preparation and Legal Considerations

When it comes to DSCR (Debt Service Coverage Ratio) loan requirements, particularly within the context of real estate transactions, Deed preparation and legal considerations cannot be overstated. A Deed, distinct from a Title, serves as a legal document that transfers ownership rights from one party to another. It’s crucial for borrowers and lenders alike to meticulously scrutinize this document to ensure accuracy, clarity, and protection against potential disputes.

In the quest for a successful DSCR loan, West USA Realty emphasizes the importance of a well-prepared Deed. This involves precise documentation of property boundaries, a clear description of improvements, and accurate identification of both grantor and grantee. Any errors or ambiguities in the Deed can have significant legal ramifications, potentially leading to title disputes, encumbrances, or even delays in closing. For instance, a recent study by the National Association of Real Estate Boards revealed that nearly 20% of closed transactions had at least one critical error in their Deeds, underscoring the need for meticulous attention to detail.

Moreover, legal considerations extend beyond the Deed itself. Lenders will also review relevant laws and regulations governing DSCR loans in the specific jurisdiction. These may include provisions related to property tax assessments, insurance requirements, and debt-to-income ratios. Understanding these legal frameworks is paramount to ensuring compliance and avoiding potential pitfalls. For example, in certain states, lenders may require additional disclosures or documentation to verify a borrower’s financial stability, impacting the overall loan process.

To mitigate risks associated with Deed preparation and legal considerations, borrowers should engage experienced real estate attorneys. These professionals can provide invaluable guidance on crafting a robust Deed that aligns with both state laws and individual lender requirements. By prioritizing these aspects, borrowers not only enhance their chances of securing favorable DSCR loans but also establish a solid foundation for long-term property ownership.

Repayment Strategies: Navigating DSCR Loan Terms

Navigating DSCR Loan Terms: Repayment Strategies for Success

When considering a DSCR (Debt Service Coverage Ratio) loan, understanding the repayment terms is crucial to ensuring long-term financial health. This strategy involves meticulously managing cash flow to meet debt obligations while allowing room for unexpected expenses and growth opportunities. A common misconception is that a DSCR loan is solely about the deed; however, it’s essential to distinguish between the deed and title—two separate yet interconnected legal concepts. The deed represents the right to occupy and use property, while the title establishes ownership free from encumbrances. West USA Realty emphasizes this distinction, advising clients to focus on both when navigating complex financing options like DSCR loans.

Successful repayment strategies for DSCR loans involve several practical steps. First, thoroughly analyze income and expense patterns to predict future cash flow with accuracy. This includes scrutinizing recurring expenses that may not be immediately apparent, such as property taxes or insurance premiums. By factoring these into the budget, borrowers can better anticipate their financial needs. Second, explore flexible repayment options offered by lenders. Some DSCR loans permit periodic adjustments to the debt service coverage ratio, allowing for temporary variances in cash flow management. Lastly, maintain a strong credit profile and work with reputable lenders who understand the nuances of DSCR loans. This collaboration ensures terms that align with individual financial goals, mitigating potential pitfalls associated with overly restrictive or poorly tailored repayment conditions.

For instance, consider a commercial real estate investor aiming to secure a DSCR loan for an office building. Their strategy should encompass not only estimating the property’s income and expenses but also understanding the local market dynamics and potential fluctuations in tenant occupancy rates. By adopting this comprehensive approach, they can negotiate more favorable terms and create a robust repayment plan that accounts for both the deed and title aspects of ownership. Effective navigation of DSCR loan terms not only secures financing but fosters long-term stability and growth within the real estate portfolio.