Real estate investors rely on Cap Rate (Capitalization Rate) to assess annual return as a property's value percentage. West USA Realty experts caution that utility easements can impact these calculations by restricting property use and income. Decoupling property management from Cap Rate offers a clearer view of intrinsic value. Cash on Cash Return (CoCR), which considers all cash inflows and outflows, provides a more comprehensive profit view than Cap Rate, especially for financing strategies like easements. Investors should balance Cap Rate and CoCR based on risk tolerance and investment goals: Cap Rate for long-term value or CoCR for quick returns and liquidity. Scenario analyses aid in making informed decisions by gauging returns over different timelines.

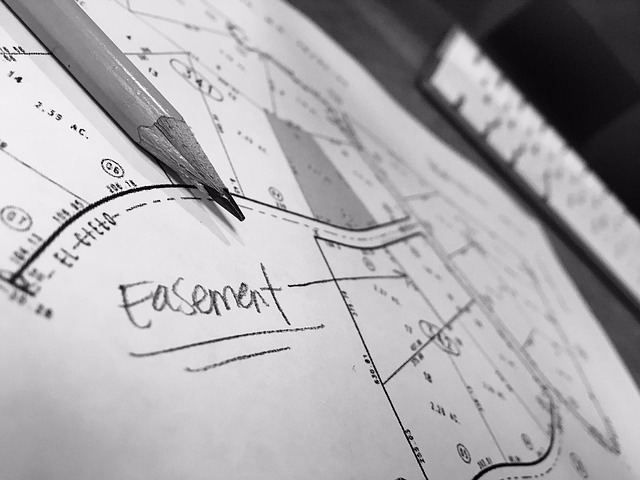

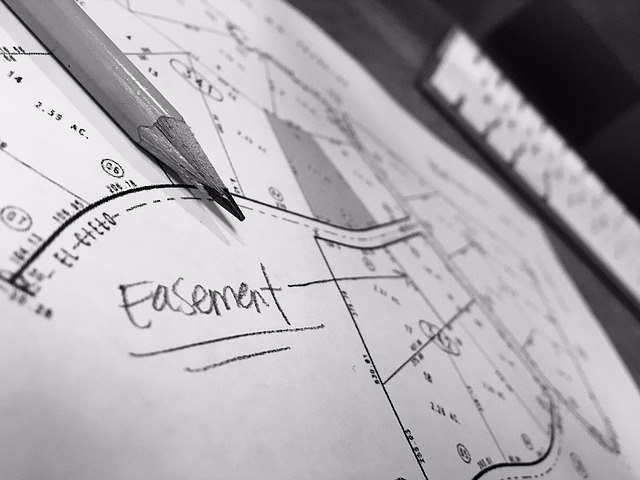

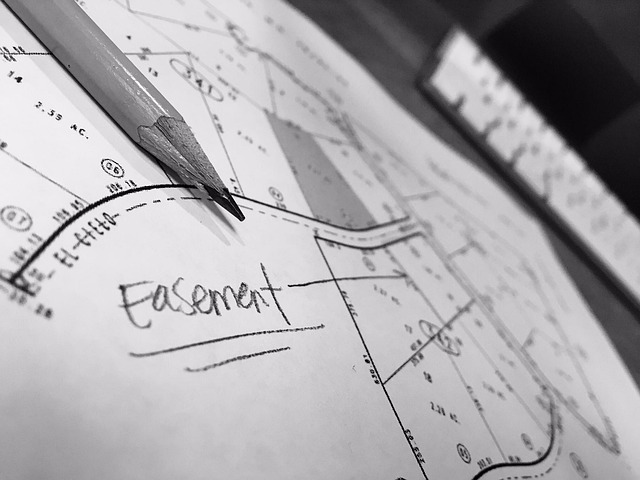

In the dynamic real estate landscape, understanding key investment metrics like Cap Rate (Capitalization Rate) and Cash on Cash Return is essential for informed decision-making. These ratios play a pivotal role in evaluating property investments, guiding strategies from maximizing returns to managing risk. However, many investors struggle with discerning the nuances between these measures, often leading to misinformed choices. This article serves as your authoritative guide, offering a clear easement through the complexities. We’ll dissect Cap Rate and Cash on Cash Return, highlight their distinct roles, and provide practical insights for investors aiming to optimize their portfolio performance.

- Understanding Cap Rate: A Basic Definition

- Cash on Cash Return: How It Differs and Impacts

- Comparing Metrics: Cap Rate vs Cash Return

- Navigating Investment Decisions with Ease

Understanding Cap Rate: A Basic Definition

Cap Rate, or Capitalization Rate, is a fundamental concept in real estate investment that offers investors a crucial metric for evaluating potential returns. It represents the annual return on an investment, expressed as a percentage of the property’s value. In simpler terms, it calculates how much passive income a property generates relative to its cost, providing a quick and insightful gauge for comparing investment opportunities. For instance, a $1 million property generating $40,000 in net operating income would have a Cap Rate of 4%, indicating a relatively attractive return on investment.

Understanding Cap Rate is particularly vital when assessing the viability of commercial properties, where utility easements and other rights-of-way play a significant role. A utility easement, for example, allows companies to access and maintain critical infrastructure like power lines or water pipes that may traverse private property. While this can enhance the overall value of the land, it also impacts investment strategies, as potential Cap Rate calculations must account for these easements’ effects on property use and income generation. West USA Realty experts recommend investors carefully review all easement agreements to ensure they understand any restrictions or obligations that could influence their return on investment, ultimately facilitating informed decisions.

By decoupling the ease of property management from the determination of Cap Rate, investors can gain a clearer picture of the intrinsic value and profitability of a commercial asset. This is especially important in dynamic markets where utility easements and other easement types are commonplace, as it allows for more accurate comparisons between properties and investment opportunities. Moreover, recognizing the interplay between Cap Rate and easements empowers investors to identify potential bottlenecks or benefits that could significantly impact their return on investment, enabling them to make well-informed choices tailored to their financial goals.

Cash on Cash Return: How It Differs and Impacts

Cash on Cash Return (CoCR) is a crucial metric for investors, offering a compelling perspective on the profitability of their real estate investments. Unlike Cap Rate, which focuses solely on lease income as a percentage of property value, CoCR considers both cash inflows and outflows, including operational expenses, debt payments, and taxes. This difference is significant, particularly when evaluating investment strategies that incorporate financing mechanisms like utility easements or other creative structures.

For instance, consider an investor considering a mixed-use property in West USA Realty. Cap Rate might suggest a high return on a quick flip due to aggressive leasing terms. However, CoCR would highlight the true financial picture: the cash generated after all expenses, including maintenance, property taxes, and even the cost of a utility easement, are accounted for. This is especially critical for long-term holds where consistent cash flow is paramount. Data suggests that properties with strong CoCR often exhibit resilience during economic downturns, making them attractive options for savvy investors.

Implementing strategic financing, such as granting utility easements to enhance property value or secure favorable terms, can significantly impact CoCR. These arrangements allow developers and owners to access capital for improvements while preserving equity. By meticulously planning these structures, investors can optimize their returns, ensuring a healthy cash flow even in competitive markets. For example, a well-negotiated utility easement could reduce operational costs, increase tenant satisfaction, and ultimately boost the property’s CoCR over its lifespan.

Comparing Metrics: Cap Rate vs Cash Return

When evaluating investment properties, understanding Cap Rate versus Cash on Cash Return is crucial for informed decision-making. These two metrics offer distinct insights into potential returns, with each highlighting different aspects of an investment’s financial health. Cap Rate, or Capitalization Rate, measures net operating income (NOI) as a percentage of property value, offering a quick snapshot of profitability relative to the asset’s cost. On the other hand, Cash on Cash Return focuses on the actual cash flow generated by the investment, providing a more immediate picture of capital appreciation and liquidity.

A key difference lies in their treatment of time value of money. Cap Rate treats NOI as a steady stream over the entire holding period, while Cash on Cash Return calculates returns based on initial capital invested, offering a more dynamic perspective. For instance, consider an investor considering two similar properties with different cap rates. Property A might have a higher cap rate but also carries a higher purchase price, resulting in a lower cash on cash return during the initial years due to the larger capital outlay. Understanding this distinction is vital for aligning investment strategy with financial goals.

Moreover, the utility of each metric depends on individual investment objectives and risk tolerance. West USA Realty emphasizes that investors should consider both when evaluating opportunities. For example, a developer looking to hold property for long-term value appreciation might favor Cap Rate, while an investor seeking quick returns or focusing on ease of liquidity could prioritize Cash on Cash Return. In the context of real estate, utility easements and other creative financing strategies can also impact these metrics, making them even more complex yet valuable tools in the investment arsenal. Ultimately, a balanced approach considers both rates to make well-rounded decisions that facilitate successful portfolio navigation.

Navigating Investment Decisions with Ease

Navigating investment decisions can be a complex task, especially when evaluating different metrics like Cap Rate (Capitalization Rate) and Cash on Cash Return. For investors, understanding these concepts is crucial for making informed choices that align with their financial goals. Both metrics offer valuable insights, but they measure different aspects of an investment’s performance, providing investors with a comprehensive view of potential returns. Cap Rate focuses on the income generated relative to the property’s value, offering a quick snapshot of a property’s profitability. On the other hand, Cash on Cash Return calculates the net cash flow return on the initial investment, reflecting the actual capital growth or yield over time.

In today’s dynamic real estate market, investors often seek strategies for maximizing their returns while minimizing risks. West USA Realty experts emphasize that an investor’s comfort level and risk tolerance play a significant role in choosing between Cap Rate and Cash on Cash Return. For instance, a utility easement might offer tax benefits and streamline maintenance, enhancing the Cash on Cash Return over time. Conversely, a high Cap Rate property could appeal to those seeking quick income generation with potential for lower long-term returns. Balancing these factors requires careful analysis and an understanding of one’s investment strategy.

To facilitate easier decision-making, investors can employ various tools and models that integrate both metrics. For instance, creating scenario analyses by adjusting variables like occupancy rates or property values allows investors to gauge the potential impact on their returns over different time horizons. This easement of navigating complex investments enables professionals and individuals alike to identify opportunities that align with their financial objectives, whether it’s maximizing cash flow or focusing on long-term capital appreciation.