Real estate investors rely on Cap Rate (Capitalization Rate) and Cash on Cash Return (CoCR) to assess investment profitability. Cap Rate, a traditional measure, reflects annual return based on property cost and net operating income. CoCR, focusing on cash flow efficiency, compares income to total equity invested. Entitlements—permits for land development—significantly influence both metrics, impacting construction timelines, rental rates, and property value. Successful investors balance CoCR (favorable for shorter-term, lower-equity investments) with Cap Rate (stronger for long-term, high-value plays), diversifying portfolios for optimal returns.

In the complex landscape of real estate investment, understanding key metrics is paramount for informed decision-making. Two essential concepts—Cap Rate (Capitalization Rate) and Cash on Cash Return—are pivotal for gauging investment performance and entitlements. Yet, confusion often arises when distinguishing between these measures. This article aims to demystify Cap Rate versus Cash on Cash Return, providing investors with a comprehensive framework to evaluate opportunities, optimize returns, and navigate the market with confidence. By the end, readers will possess the knowledge to make strategic choices, ensuring their investments align with their financial goals and entitlements.

- Understanding Cap Rate: The Traditional Measure

- Cash on Cash Return: Unlocking Investment Entitlements

- Comparing Metrics: Maximizing Real Estate Returns

Understanding Cap Rate: The Traditional Measure

Cap Rate, or Capitalization Rate, is a traditional measure used in real estate to evaluate investment properties. It represents an estimated annual return on an investment based on a property’s sale price and its net operating income (NOI). In essence, it’s a way to understand how much rental income you can expect to earn relative to the purchase cost. A higher Cap Rate indicates a potentially more attractive investment opportunity, as it suggests a higher return on entitlements. For instance, consider two similar properties: one with a Cap Rate of 6% and another at 8%. The latter would be considered a stronger investment based solely on this metric, assuming all other factors remain equal.

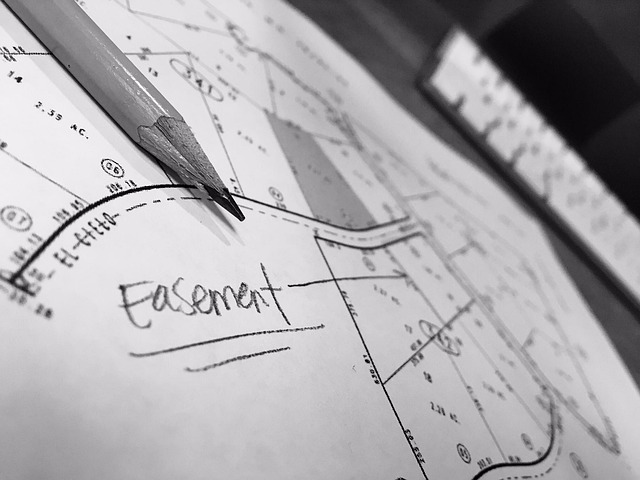

Understanding Cap Rate requires a grasp of the entitlement process, which involves securing the necessary permits and approvals to develop or utilize land for specific purposes. This process can significantly impact investment returns. West USA Realty experts emphasize that entitlements are crucial in determining a property’s long-term value and profitability. For example, a developer may acquire a plot of land with a favorable Cap Rate but face lengthy and costly entitlement hurdles that delay project completion and reduce overall return on investment. Conversely, securing entitlements quickly can expedite construction and market entry, potentially enhancing the property’s cash flow potential.

While Cap Rate is a critical indicator, it’s not the sole factor in evaluating real estate investments. Cash on Cash Return (CoCR) considers an investor’s initial capital outlay and the subsequent cash inflows to assess the viability of an investment. CoCR provides a more immediate understanding of how quickly an investment generates profit. For instance, if an investor puts up $100,000 and receives $20,000 in rent annually, the CoCR is 20%, indicating a strong cash flow return on their entitlements. A balanced approach that considers both Cap Rate and CoCR ensures investors make informed decisions, weighing the traditional measure against current cash flows to optimize portfolio performance.

Cash on Cash Return: Unlocking Investment Entitlements

The concept of Cash on Cash Return (CoC) is a critical metric for investors seeking to unlock the full potential of their real estate investments. This financial measure goes beyond simply calculating income and provides valuable insights into the profitability and efficiency of an investment, especially when considering entitlement process implications. Entitlements, in this context, refer to the various permissions and benefits associated with land use and development, which can significantly impact an investor’s overall return.

When evaluating a property, CoC considers the cash flow generated relative to the capital invested. A higher Cash on Cash Return indicates a more efficient investment, where the income generated exceeds expectations. For instance, imagine two similar properties with different entitlement processes. Property A, with straightforward zoning and development rights, may offer a 10% CoC, while Property B, entangled in complex entitlement processes, could yield a 6% return. The disparity highlights how entitlements can influence investment outcomes. West USA Realty experts emphasize that understanding these processes is key to making informed decisions.

The entitlement process plays a pivotal role in determining the accessibility and profitability of investment opportunities. It involves navigating local regulations, acquiring necessary permits, and ensuring compliance with zoning laws. By meticulously managing this process, investors can secure better terms and conditions, leading to enhanced returns. For example, pre-approvals for development plans can expedite projects, reducing time and costs. This strategic approach ensures that the investment not only generates a strong CoC but also reaps the full entitlement benefits, ultimately maximizing financial entitlements.

Comparing Metrics: Maximizing Real Estate Returns

When evaluating real estate investments, understanding key performance metrics like Cap Rate (Capitalization Rate) and Cash on Cash Return (CoCR) is essential for maximizing returns. Both metrics offer valuable insights into potential rental income and investment profitability, but they measure different aspects of an asset’s value. Cap Rate focuses on the property’s overall market value by dividing net operating income by the current price, providing a percentage-based valuation. For instance, a $1 million property generating $60,000 in annual net income has a Cap Rate of 6%.

Cash on Cash Return, on the other hand, assesses an investment’s immediate cash flow efficiency by comparing the net operating income to the total equity invested. If you’ve invested $500,000 in a property and receive $25,000 annually in cash distributions, your CoCR is 5%. This metric is particularly useful for understanding how quickly your capital is returned or reinvested within a project.

The entitlement process plays a significant role in both metrics. Obtaining necessary permits and approvals can impact construction timelines, rental rates, and overall property value. For example, West USA Realty might navigate a complex entitlement process to develop a mixed-use property, ensuring higher rents and a favorable Cap Rate upon completion. Understanding these dynamics allows investors to make informed decisions, balancing potential returns with investment risks.

When comparing the two, CoCR often favors shorter-term, lower-equity investments while Cap Rate shines in long-term, high-value plays. A savvy investor might leverage both by diversifying their portfolio, utilizing a mix of equity and debt to optimize Cash on Cash Return while strategically acquiring properties with strong growth potential for higher Cap Rates.