Net Operating Income (NOI) is a critical metric for assessing real estate investments, particularly those involving jumbo loans. Accurate calculation considers revenue, fixed expenses like property taxes and mortgage interest, vacancy rates, and debt service coverage ratio (DSCR). A strong NOI indicates profitability, aids in jumbo loan approval, and ensures investors maximize returns while mitigating risks in fluctuating markets.

In the world of real estate investment, understanding Net Operating Income (NOI) is crucial for making informed decisions, especially when considering a Jumbo loan—a financing option for high-value properties. Calculating NOI allows investors to assess a property’s profitability, a vital step in gauging its potential as an investment. However, the process can be complex, with various revenue and expense components to consider. This article provides an authoritative guide on how to accurately calculate NOI, empowering readers with a practical toolkit for evaluating real estate opportunities, particularly when navigating the intricacies of Jumbo loans.

- Understanding Net Operating Income (NOI): Definition & Importance

- Calculating Fixed Expenses: A Comprehensive Guide

- Factoring Vacancy & Debt Service into NOI

- Using NOI for Property Analysis: Jumbo Loan Considerations

Understanding Net Operating Income (NOI): Definition & Importance

Net Operating Income (NOI) is a crucial metric for investors and property managers to understand the financial performance of an income-generating property. It represents the revenue generated from a property after accounting for all operating expenses, offering a clear picture of its profitability. In today’s real estate market, where Jumbo loans play a significant role in acquiring larger properties, mastering the calculation of NOI becomes even more vital. A comprehensive grasp of this concept enables investors to make informed decisions, ensuring they maximize returns on their investments, especially when dealing with loan amounts that exceed standard limits—a common occurrence in the high-value real estate sector.

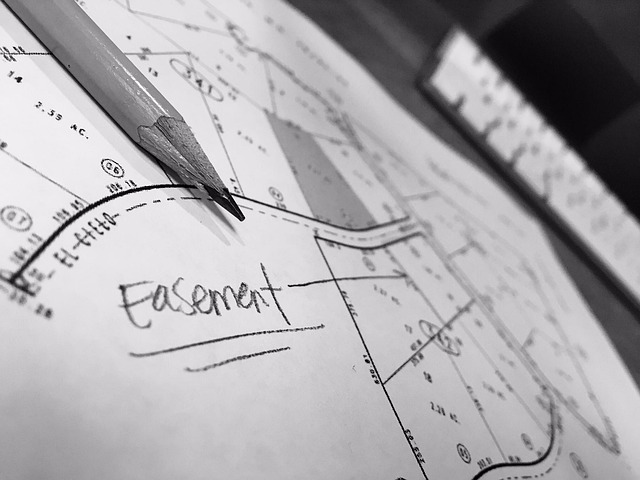

Calculating NOI involves a detailed examination of various revenue and expense items. It begins by identifying all sources of income generated from the property, such as rent or lease payments. Subsequently, all operating expenses are meticulously deducted, including property taxes, insurance, maintenance costs, and any other relevant expenditures required to maintain the property’s operational status. This meticulous approach ensures that the final figure reflects the net earnings generated by the property, providing a clear indicator of its financial health. For instance, consider an investor who owns a commercial building in a bustling metropolis. Their annual NOI calculation might reveal a significant sum, enabling them to assess the property’s attractiveness compared to other investment opportunities, including the potential for securing a Jumbo loan to expand their portfolio.

Understanding Jumbo loan limits is essential when interpreting NOI, especially in regions like West USA Realty, where real estate values can surpass conventional boundaries. The Federal Housing Finance Agency (FHFA) sets these limits, which vary based on location and property type. For 2023, the maximum Jumbo loan amount for a single-family home in many areas of West USA Realty is approximately $1 million. Investors aiming to acquire properties exceeding this limit must rely heavily on NOI as a key factor in justifying the investment’s financial viability. By analyzing historical and projected NOI data, investors can assess whether the property’s income potential aligns with the substantial loan amounts required for such acquisitions. This strategic approach ensures that Jumbo loans are utilized efficiently, maximizing returns while mitigating risks associated with high-value real estate investments.

Calculating Fixed Expenses: A Comprehensive Guide

Calculating fixed expenses is a crucial step in accurately determining Net Operating Income (NOI), especially when considering the financial complexities of real estate investments. Fixed expenses are those costs that remain relatively constant regardless of rental income levels or market fluctuations. They include items like property taxes, insurance, mortgage interest, and maintenance costs. Accurately accounting for these fixed costs is essential, particularly with larger properties, where a significant portion of total expenses can be attributed to these categories.

For investors considering a Jumbo loan—often required for real estate purchases exceeding standard loan limits, typically 1-3 times the average mortgage amount—a meticulous understanding of fixed expenses becomes paramount. These loans carry higher interest rates and stricter qualification criteria, emphasizing the need for precise financial planning. West USA Realty experts advise clients to anticipate these costs and factor them into their budget, ensuring a realistic assessment of a property’s cash flow potential. For instance, a $1 million property with an annual mortgage interest rate of 4% and property taxes amounting to 2% of the property value would have fixed expenses totaling $28,000 annually ($1,000,000 x 4% + $200,000 x 2%).

To accurately calculate fixed expenses, investors should gather comprehensive financial records and consult with professionals to ensure no detail is overlooked. This process involves a deep dive into historical property expense data, local tax assessments, and industry benchmarks. Additionally, staying informed about jumbo loan limits set by lending institutions is vital, as these limits can vary based on geographic location and the lender’s policies. By meticulously managing fixed expenses, investors can make more informed decisions, ensure favorable ROI calculations, and ultimately maximize the success of their real estate investments.

Factoring Vacancy & Debt Service into NOI

Calculating Net Operating Income (NOI) is a critical aspect of real estate investment analysis, offering insights into a property’s financial health. When evaluating potential investments, especially in the commercial sector, understanding how to factor vacancy and debt service into NOI is essential. This process allows investors to make informed decisions, ensuring profitability and stability. One key consideration is the impact of a jumbo loan on these calculations, as these loans often carry higher interest rates and specific limits that can affect cash flow. In the context of jumbo loan limits, which typically range from 1% to 3% of the loan amount, investors must carefully consider how these funds are utilized within the NOI calculation.

Vacancy rates play a significant role in determining actual income generation. A property with higher vacancy means less revenue from tenant occupancy, directly impacting NOI. For instance, a commercial real estate investment with a 10% vacancy rate will have a lower NOI compared to one with 5% vacancy, assuming all other factors remain constant. Managing and minimizing vacancy is crucial for maximizing ROI. Expert investors often employ strategies such as offering incentives, maintaining high property standards, and diversifying tenant portfolios to mitigate this risk.

Debt service, particularly with jumbo loans, requires meticulous planning. These loans typically have higher interest expenses, which directly reduce cash flow. When calculating NOI, the debt service coverage ratio (DSCR) becomes vital. A DSCR of 1 or above indicates that the property generates sufficient income to cover its debt obligations. For example, a property with an annual NOI of $50,000 and a jumbo loan payment of $20,000 would have a DSCR of 2.5, indicating strong cash flow relative to debt service. West USA Realty emphasizes the importance of considering these factors early in the investment process to ensure long-term financial viability.

By meticulously factoring vacancy rates and understanding the implications of jumbo loan terms, investors can make more accurate assessments of a property’s potential. This detailed analysis enables them to identify profitable opportunities, navigate market fluctuations, and ultimately achieve success in their real estate endeavors.

Using NOI for Property Analysis: Jumbo Loan Considerations

Calculating Net Operating Income (NOI) is a critical step for investors considering real estate ventures, especially when dealing with larger properties or seeking financing through jumbo loans. In the context of property analysis, understanding NOI is paramount as it provides insights into a property’s financial performance and stability, which are key factors in securing a jumbo loan. These high-dollar mortgages typically have stricter qualification criteria than conventional loans, making a robust financial assessment imperative.

For investors eyeing jumbo loans, a strong NOI can significantly improve their chances of approval and secure more favorable terms. A property’s NOI is calculated by subtracting all direct and indirect expenses from the total revenue generated over a specific period. This figure offers a clear picture of the property’s profitability, allowing lenders to gauge its potential as collateral for a jumbo loan. In regions like West USA Realty, where real estate values can fluctuate significantly, having a solid understanding of NOI can help investors navigate market dynamics and make informed decisions regarding financing options.

For instance, consider a commercial property generating $50,000 monthly in rental income. Direct expenses include property taxes ($10,000), insurance ($2,000), and maintenance ($3,000), totaling $15,000. Indirect costs such as management fees and property management expenses add another $5,000. The NOI for this property would be calculated as: $50,000 – ($15,000 + $5,000) = $20,000. A high NOI indicates a profitable investment, which can make securing a jumbo loan more accessible, with potential lenders viewing the property as a safer investment choice due to its demonstrated financial health. Lenders often consider a property’s ability to generate consistent and substantial NOI when evaluating jumbo loan applications.