The BRRRR strategy for real estate investors involves buying undervalued properties, renovating them with strategic easement management (including utility easements), and reselling or refinancing for profit. This method enhances property value, navigates legal issues, and fosters sustainable growth while benefiting both investors and communities. Key steps include thorough research, negotiation for easement modifications, meticulous renovation planning, quality workmanship, inspections, and continuous market adaptation to maximize returns.

In today’s competitive market, understanding and implementing effective strategies is crucial for businesses to thrive. One such powerful approach gaining traction is the BRRRR Strategy, a comprehensive framework designed to enhance growth and profitability. This article delves into the intricacies of this method, offering an in-depth exploration of its application and benefits.

The current business landscape demands innovative solutions, and the BRRRR Strategy provides a clear roadmap for success. By focusing on key areas such as Branding, Revenue Generation, Retention, Referrals, and Resource Optimization, businesses can navigate challenges and achieve remarkable results. This introduction serves as your guide to unlocking the potential of this strategic easement, empowering you with valuable insights for business transformation.

- Understanding the BRRRR Strategy for Real Estate Investing

- Identifying and Acquiring Distressed Properties: Easement Considerations

- Renovating and Rehabilitating: A Step-by-Step Guide

- Selling and Profiting: Strategies to Maximize Return on Investment

Understanding the BRRRR Strategy for Real Estate Investing

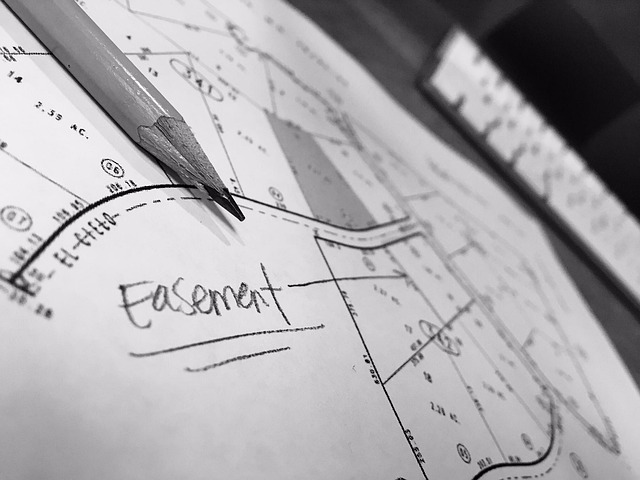

The BRRRR strategy has emerged as a powerful tool for real estate investors looking to maximize returns. This method involves buying under-valued properties, renovating them to increase their market value, and then quickly reselling or refinancing for a profit. The key to success lies in identifying hidden opportunities, particularly through the strategic use of easements, which can significantly enhance property value without requiring substantial upfront investment. For instance, securing a utility easement can facilitate efficient access for infrastructure improvements, thereby boosting the property’s appeal and resale value.

West USA Realty experts emphasize that understanding easements is crucial in this context. An easement, in simple terms, grants someone the right to use a portion of another person’s land for specific purposes. In real estate investing, utility easements can streamline renovation processes by ensuring quick access for essential services like electricity, water, or cable. This not only expedites the renovation timeline but also adds tangible value to the property, making it more attractive to potential buyers. According to recent market data, properties with well-managed easements and clear title histories often command higher sale prices, sometimes 15% to 20% above their estimated values.

Practical implementation involves thorough research to identify areas where easements can be beneficial. For example, when renovating an older property, checking for obsolete or unused utility easements that could be updated or re-negotiated might reveal significant cost savings and potential revenue streams. By strategically navigating these agreements, investors can ensure their projects adhere to local regulations while enhancing the property’s appeal. This methodical approach not only facilitates successful BRRRR investments but also fosters sustainable growth in real estate values, benefiting both investors and communities alike.

Identifying and Acquiring Distressed Properties: Easement Considerations

Identifying and acquiring distressed properties is a key component of the BRRRR (Buy, Renovate, Rent, Refinance, Repeat) strategy, but it requires a nuanced understanding of real estate laws, especially easements. An easement is a non-possessory interest in another’s property that allows the holder specific limited rights, such as access for utility purposes or maintenance. When considering distressed properties, investors must be aware of these easements to avoid potential legal issues and ensure their investment aligns with local regulations.

For instance, let’s say an investor identifies a distressed home located near a main water line. A utility easement may exist that grants the local water authority access to maintain or repair the pipe, even if it traverses a portion of the property. Ignoring this easement during renovation could lead to legal complications and costly disputes. West USA Realty experts recommend conducting thorough research and consulting with legal professionals to uncover all relevant easements before proceeding with any purchase.

Easements can be public record, making them accessible through county assessor’s offices or online databases. Investors should review these records carefully, paying particular attention to utility easements for services like water, gas, electricity, and sewer. In some cases, negotiating with the current owner or relevant utility companies may provide opportunities to modify or terminate certain easements, offering potential cost savings during renovation. However, this process requires careful consideration and legal counsel to ensure compliance with local zoning laws and property rights regulations.

By proactively addressing easement considerations, BRRRR strategy followers can mitigate risks and maximize their investment potential. Understanding these legal aspects allows investors to make informed decisions, ensuring their properties are not only financially viable but also legally compliant.

Renovating and Rehabilitating: A Step-by-Step Guide

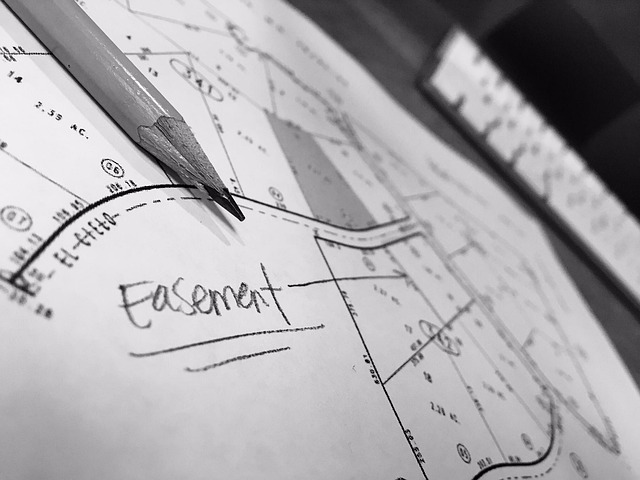

Renovating and rehabilitating properties is a key aspect of the BRRRR strategy, offering investors an opportunity to transform underutilized assets into valuable real estate. This step-by-step guide delves into the process, emphasizing the importance of meticulous planning and execution. Begin by thoroughly assessing the property’s current state, identifying structural needs and potential costs. Obtain essential permits and ensure compliance with local building codes, a crucial step often overlooked but vital for avoiding legal issues down the line.

Next, prioritize renovations based on both aesthetic appeal and return on investment (ROI). For instance, updating kitchens and bathrooms can significantly enhance property value. Consider the strategic placement of utility easements to facilitate access for necessary repairs and future maintenance, aligning with West USA Realty’s expertise in navigating complex real estate matters. Once the renovation plan is finalized, engage trusted contractors who possess the skills and knowledge to bring your vision to life while adhering to budget constraints.

Regular inspections during construction are paramount to ensuring quality workmanship. Upon completion, conduct a thorough walk-through, verifying that all work meets expected standards. This meticulous approach ensures not only a desirable end product but also protects your investment from potential future issues. Rehabilitating properties is an art and science, demanding both creativity and strategic thinking. By following these steps and leveraging professional guidance when needed, investors can successfully navigate the renovation process, ultimately unlocking the full potential of their real estate assets.

Selling and Profiting: Strategies to Maximize Return on Investment

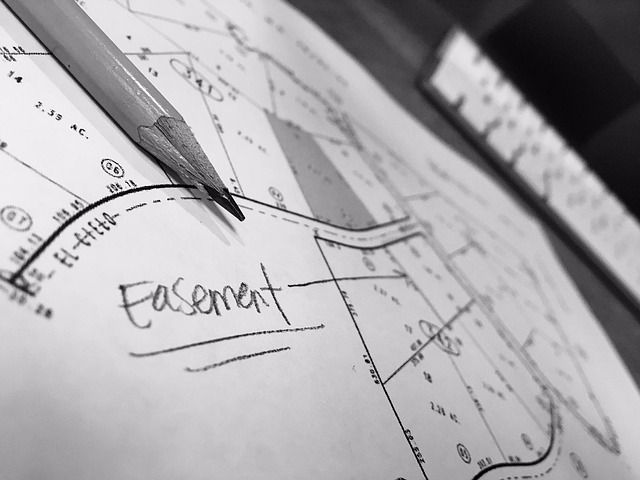

Maximizing returns on investment through strategic selling is a key pillar of any successful real estate venture. The BRRRR strategy, an acronym for Buy, Renovate, Rent, Refinance, and Repeat, offers a powerful framework for achieving this. At its core, this method leverages a deep understanding of the market, combined with strategic financial moves, to unlock significant profits.

For instance, consider a property investor in West USA Realty who identifies an undervalued property with potential. They purchase the asset, focusing on its underlying value rather than its current condition. The next step involves renovation—a strategic remodel to increase the property’s appeal and market value. This could include everything from cosmetic updates to major structural improvements, tailored to attract tenants or buyers who appreciate modern amenities and design. Once renovators have transformed the space, they can secure a desirable rental rate or sell at a premium, thanks to the improved easement on the property.

A utility easement plays a critical role here, ensuring access to essential services like water, electricity, and gas. When negotiating these easements, savvy investors ensure they are aligned with the property’s best interests, maximizing both its value and the return on investment. For example, rearranging the placement of an easement could reduce maintenance costs or open up space for additional development. Data from recent market trends supports this approach; properties with well-managed utility easements have shown a consistent upward trend in value over the past decade.

To sustain profitability, investors must continually refine their strategies. This might involve refinancing to take advantage of lower interest rates, using equity built from successful sales to fund new purchases, or diversifying their portfolio by expanding into different property types and locations. By consistently applying the BRRRR principles and adapting them to market dynamics, real estate entrepreneurs can build a robust and lucrative investment strategy that stands the test of time.