The 1031 Exchange is a tax-efficient strategy for real estate investors, allowing them to swap properties while deferring capital gains taxes. IRS regulations emphasize similar usage, location, and quality between old and new properties. Adjustable-rate mortgages (ARMs) can finance both transactions, saving costs, but require careful consideration due to interest rate fluctuations. Strategic planning with financial advisors is crucial for compliance and maximizing benefits, especially in today's dynamic market. Key steps include identifying qualifying properties, conducting comparability analysis, managing timing, and navigating negotiations. Common mistakes involve inadequate ARM research, delayed document submission, overlooking tax implications, and ignoring market conditions. West USA Realty advises working with experienced professionals to successfully navigate these complexities.

The 1031 Exchange, a cornerstone of tax-efficient real estate investing, offers significant advantages for property owners looking to exchange one asset for another without incurring capital gains taxes. As an ARM (Adjustable Rate Mortgage) strategy, it allows investors to navigate complex financial landscapes, leveraging market dynamics to their advantage while minimizing tax burdens. However, navigating these rules can be intricate, with strict guidelines and potential pitfalls. This article provides a comprehensive guide to demystifying the 1031 Exchange process, ensuring readers gain a thorough understanding of its application, benefits, and best practices for successful implementation.

- Understanding the Basics of 1031 Exchanges

- Eligibility Requirements for Tax-Free Exchange

- Types of Property Involved in a 1031 Exchange

- ARM and Its Role in Facilitating Exchanges

- The Process: Steps to Complete a Successful Exchange

- Common Mistakes to Avoid During the Exchange

Understanding the Basics of 1031 Exchanges

The 1031 Exchange is a powerful tool for real estate investors looking to exchange one property for another while deferring capital gains taxes. At its core, this process allows investors to trade a property they own – typically income-generating real estate – for a new property of equal or greater value, without incurring tax liability on the original sale. This strategy is particularly valuable in today’s dynamic market where properties can appreciate significantly over time.

Understanding the basics involves grasping how 1031 exchanges operate within the existing tax code. The IRS strictly regulates these transactions to prevent abuse. Investors must identify and acquire a “like-kind” property within a specific timeframe – typically 45 days – following the sale of their original asset. This new property serves as an exchange equivalent, reflecting similar characteristics such as usage, location, and quality. For example, exchanging a single-family rental home for another multi-family investment property qualifies as a like-kind exchange.

An ARM (adjustable-rate mortgage) can play a crucial role in these transactions. Investors often leverage the flexibility of an ARM to finance both the original property and the new acquisition, potentially reducing out-of-pocket expenses. However, it’s important to consider the potential interest rate fluctuations associated with ARMs. West USA Realty experts recommend carefully evaluating market conditions and consulting with financial advisors before proceeding. By strategically planning and executing a 1031 exchange, investors can navigate tax complexities while seizing opportunities for growth in the real estate market.

Eligibility Requirements for Tax-Free Exchange

The 1031 Exchange is a powerful tool for investors looking to exchange one investment property for another while deferring capital gains taxes. However, navigating the eligibility requirements can be complex. To take full advantage of this tax-efficient strategy, it’s crucial to understand who qualifies for these exchanges. One common scenario involves individuals with adjustable-rate mortgages (ARMs), which can impact their eligibility in unique ways.

While traditional 1031 exchanges typically focus on direct property swaps, ARMs introduce a layer of complexity. The primary concern revolves around the requirement for “like-kind” assets. In simple terms, this means exchanging one investment property for another that produces similar cash flows and use. An investor with an ARM might face challenges if their new acquisition includes fixed-rate components or different loan structures. For instance, exchanging a property with an ARM for a fixed-rate mortgage property would likely not qualify as like-kind under IRS guidelines. The key lies in maintaining the essential character of both properties’ cash flows throughout the exchange process.

West USA Realty experts advise clients to consider their financial position and future plans carefully before initiating a 1031 Exchange. For ARM holders, understanding the potential impact on eligibility is paramount. An adjustable-rate mortgage, while offering potentially lower initial payments, introduces variable rates over time. This variability could affect the like-kind assessment during an exchange. To mitigate risks, investors should consult with tax professionals and real estate specialists who can guide them through the process, ensuring compliance and maximizing the benefits of their 1031 Exchange strategy.

Types of Property Involved in a 1031 Exchange

When planning a 1031 Exchange, understanding the types of property involved is crucial. This strategic financial tool allows investors to defer capital gains taxes on qualified real estate transactions, offering significant advantages for those navigating the complex world of commercial and residential investments. The key lies in recognizing that these exchanges can encompass a diverse range of properties, each presenting its own set of rules and considerations.

Commercial properties, such as office buildings, retail spaces, and industrial facilities, are common participants in 1031 Exchanges. These assets often come with complex financing structures, including adjustable-rate mortgages (ARMs), which can add a layer of complexity to the exchange process. For instance, an investor with a high-value commercial property secured by an ARM might opt for a like-kind exchange, replacing their existing asset with another commercial property of equal or greater value. The ARM’s variable interest rates become a factor in timing and structuring the new loan, ensuring the exchange aligns with tax-efficient strategies.

Residential properties also play a substantial role, especially in regions like West USA Realty’s focus areas. Single-family homes, apartments, and condominiums can all be part of these exchanges. In some cases, investors may leverage adjustable-rate mortgages for residential properties, offering initial lower interest rates that can impact the overall tax strategy. For example, an investor looking to exchange a primary residence with a new property might consider an ARM to manage cash flow during the exchange period, ensuring a smoother transition without disrupting their daily lives.

Expert advice suggests that understanding the specific characteristics of each property type and its financing is essential. The 1031 Exchange rules allow for flexibility in asset classes, but navigating ARMs requires careful consideration. Tax professionals and real estate specialists should collaborate to ensure compliance and optimize the exchange process, especially when dealing with adjustable-rate mortgages. By recognizing the diverse nature of properties involved, investors can make informed decisions, leveraging the 1031 Exchange to their advantage in today’s dynamic market.

ARM and Its Role in Facilitating Exchanges

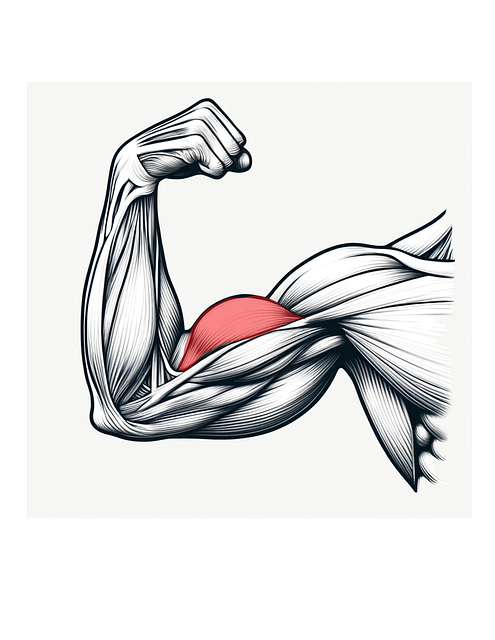

Adjustable-rate mortgages (ARMs) play a pivotal role in facilitating 1031 exchanges, offering flexibility and potential cost savings for investors and property owners. ARMs, as their name suggests, allow borrowers to adjust their interest rates periodically based on market conditions. This feature is particularly advantageous when navigating the complexities of 1031 exchanges, which involve the exchange of one investment property for another without incurring taxable consequences.

During a 1031 exchange, investors often look to minimize capital gains taxes while preserving liquidity. ARMs can help achieve this by offering lower initial interest rates compared to fixed-rate mortgages, thereby reducing monthly payments and potentially freeing up cash flow. This flexibility is crucial when identifying and acquiring replacement properties within the required timeframe. For instance, an investor utilizing a 5/1 ARM might enjoy a lower rate for the first five years, allowing them to reinvest savings into property search and negotiations.

Moreover, West USA Realty experts suggest that ARMs can simplify the exchange process by providing predictability in future rates. While interest rate fluctuations are inherent with ARMs, borrowers can lock in rates after initial adjustments, ensuring stability over a defined period. This strategy is particularly valuable in today’s dynamic market, where interest rates can change rapidly. By understanding ARM terms and working with experienced real estate professionals, investors can confidently navigate 1031 exchanges, taking advantage of adjustable-rate mortgages to optimize their investments.

The Process: Steps to Complete a Successful Exchange

Completing a successful 1031 exchange requires a strategic, step-by-step approach to navigate the complexities of tax-deferred property transactions. This process involves careful planning, precise execution, and an in-depth understanding of the rules governing these exchanges. Here’s a detailed breakdown of the key steps involved, with a focus on maximizing efficiency and minimizing potential pitfalls.

First, identify the qualifying properties. According to IRS guidelines, a 1031 exchange applies to like-kind properties, such as residential, commercial, or investment real estate. For instance, if you’re exchanging an apartment building, it must be replaced with another property of equivalent use. Once eligible properties are identified, engage a qualified intermediary to facilitate the transaction. These intermediaries act as neutral third parties, ensuring compliance and managing the exchange process.

Next, execute a comparability analysis. This involves evaluating the exchange properties based on factors like location, size, age, condition, and market value. The goal is to demonstrate that both the properties being exchanged are of like-kind and comparable in terms of their useful life and potential rental or sales income. For example, if you’re exchanging a single-family home for a similar property, the intermediary will assess square footage, number of bedrooms and bathrooms, age, and local market trends to ensure comparability.

During the exchange period, careful timing is crucial. The IRS requires that the replacement property be identified within 45 days of closing on the property being exchanged. This prompt action ensures a seamless transition and avoids potential tax implications. Additionally, both parties must agree on the terms of the exchange, including any adjustments to the sales price, prior to closing. West USA Realty, for instance, has extensive experience guiding clients through these negotiations, ensuring favorable outcomes for all involved.

Common Mistakes to Avoid During the Exchange

When navigating a 1031 Exchange, even experienced investors can fall prey to common pitfalls that can derail their plans or lead to unnecessary delays. Understanding these mistakes is crucial for a smooth transaction. One of the most frequent errors involves failing to thoroughly research and understand the terms of the exchange, including the intricacies of an adjustable-rate mortgage (ARM). While ARMs offer potential for lower initial rates, they come with variable rate fluctuations, which can significantly impact long-term costs. For instance, a borrower assuming a 5/1 ARM might face higher payments when the introductory period ends, contrasting sharply with their original expectations.

Another mistake is underestimating the importance of timely document submission and communication with your exchange facilitator, such as West USA Realty specialists. Delays in providing required documents can lead to prolonged holdups and potential legal complications. Maintaining open lines of communication throughout the process ensures that all parties involved are aligned and aware of any changes or updates. Additionally, many investors overlook the tax implications associated with exchanges. Consult with a financial advisor to understand how gains or losses from selling one property might affect your overall tax liability.

Furthermore, failing to consider the new property’s market conditions can be detrimental. Conducting a thorough analysis of the target property’s value, location, and potential rental income is essential. For example, if a borrower exchanges for a property in a declining market or with limited rental demand, it may not generate sufficient cash flow to cover expenses, including the adjustable-rate mortgage payments. West USA Realty emphasizes the importance of working with experienced professionals who can guide investors through these complex considerations, ensuring successful and stress-free 1031 Exchanges.